Table of Content

The fine print document will contain all the information and term and conditions related to the loan you plan to apply for. If you are unable to understand the clauses mentioned in this document, then ask the help of a Chartered Accountant. LIC home loan interest rate changes every quarter following the change in RBI’s Repo Rate.

The maximum repayment age is 75 years, with the lowest EMI amount being Rs. 720 per Lakh. Bank of Baroda Home loan interest rate also starts from 7.95% and goes up to 9.30% p.a. The maximum age for loan approval is 70 years and maximum age for repayment is 78 years. A shorter tenor keeps your interest accumulation in check as the interest rate is levied for a fewer number of years. In addition, a shorter repayment timeline helps you get a more affordable interest rate from the lender. The location of a property, its current condition, and amenities available determine its resale value.

Other Loans & Products

The percentage of the principal amount that banks charge from the borrower for using the principal amount known as the interest rate. So, you can see a savings of around INR 10,76,956 (37,92,453-27,15,497) on reducing the tenure to 15 years instead of continuing it for 20 years. Yes, the EMI will rise by around INR 4,839 (37,308-32,469) when you choose a tenure of 15 years. Despite that, the EMI constitutes below 50% of your net monthly income.

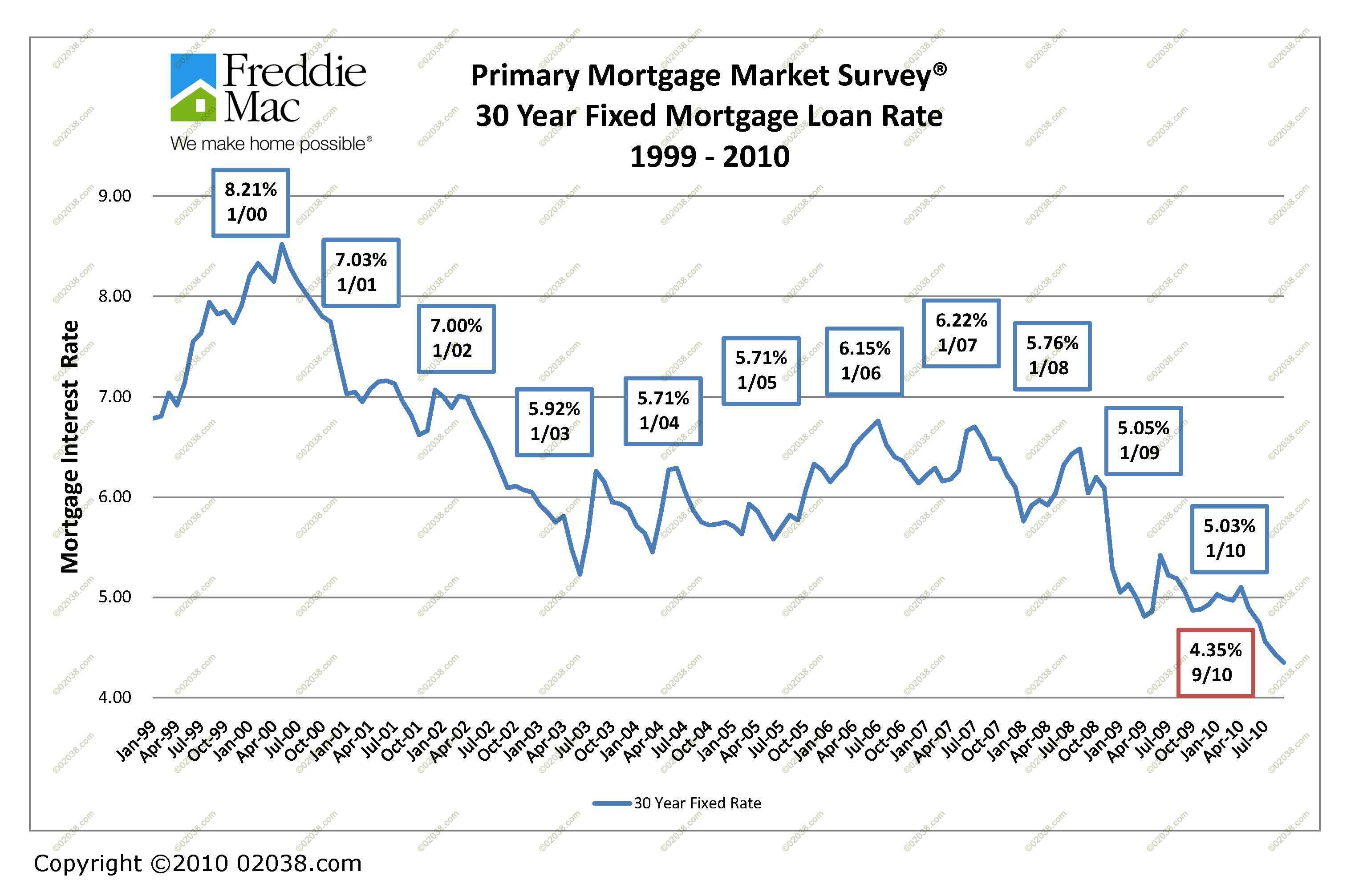

To help first-time homebuyers meet the requirements of a hefty down payment or being able to cover closing costs, Old Second participates in several affordable housing programs. But it might not be a bad financial decision to buy a house right now. Let’s talk through mortgage rates, how they work, and whether or not today is the right time to buy a home, given the state of the market. While the interest rate remains the same throughout the loan tenure in a fixed interest rate, the applicant can easily repay the loan. However, in case of floating interest rate you can take advantage of the lower interest rates during the loan tenure.

Is prepayment allowed in LIC home loan?

This will also play an important role in enhancing your eligibility for the Home Loan. One of the most effective ways to achieve lower interest rates is to use a home loan comparison service such as ooba Home Loans. As of November 2022, the prime lending rate in South Africa is 10.5%. It was increased by 0.25% in November 2021,0.25% in January 2022, 0.75% in September 2022, and now another 0.75%. Using an home loan EMI calculator is the simplest option and guarantees error-free results every time.

Use a home loan EMI calculator to check your total interest payout against your loan. Upon calculation, you will not only be able to check your EMI, but also a detailed break-up of your repayment schedule through an amortisation table. Through the amortisation table representing your repayment schedule, you can check how much interest you have paid against your loan. The current home loan interest rate on LIC housing finance ranges from 8.30% p.a.

Average mortgage interest rate by state

Our ratings take into account interest rates, lender fees, loan types, discounts, accessibility, borrower requirements and other attributes. All ratings are determined solely by our editorial team. The interest rates are reflected as annual percentage rates as of December 12, 2022. We also considered each lender’s combined loan-to-value ratio requirement, which is calculated by dividing the sum of all the loans on the property by its current value.

Choose a shorter tenure – For long term loans, though the EMI is less, the overall cost of the loan drastically increases because you are paying interest for a longer period of time. So, choose shorter tenures as the interest amount will get much lower with time. Use a home loan EMI calculator while comparing long-term and short-term home loans. To reduce your home loan interest rate you can opt for the floating rate of interest by contacting your lender.

Come July-end and we find ourselves rushing to get our financial documents in order, boo... Keeping in tune with the multiple repo rate hikes by the Reserve Bank of India to ... All in all, getting a senior citizen home loan is not a cakewalk. You need to plan the whole process carefully and do the necessary research before applying for the Home Loan. If you have any other loans, close them beforeApplying for a Home Loan.

The interest rate on a home loan will vary depending on what the bank is willing to offer, and how much of a risk they consider you to be. The interest rate on your home loan is affected by the repo rate, which is determined by the South African Reserve Bank. She has written about personal finance for over six years. Before joining the Insider team, she was a freelance finance writer for companies like SoFi and The Penny Hoarder, as well as an editor at FluentU. Then, it's time to shop around and get quotes from multiple lenders before deciding which one to use.

U.S. Bank home equity loans are available in all states. Customer support by phone is available on weekdays from 8 a.m. Home equity loans are not available in Iowa or Maryland. Customer support by phone is available Monday through Saturday from 7 a.m.

Home loan EMIs are inversely related to the repayment term, making instalments dearer for a short tenor, but keeping interest accumulation in check. On the other hand, a long tenor results in easy and affordable EMIs, but higher interest accumulation. According to FICO, only people with credit scores above 660 will truly see interest rates around the national average.

Bajaj Housing Finance extends competitive Home Loan interest rates to borrowers to make financing convenient and repayment affordable in the long term. Applicants can choose from fixed and floating rates, as per their suitability. The interest rate you receive is set by the lender based on internal policies and market conditions. To calculate the total housing loan interest you will need to pay on your home loan, you can use a home loan interest calculator. This helps you compute your EMIs and the total cost of your loan.

And you can always refinance into a shorter term mortgage. Getting a 15-year mortgage instead of a 30-year mortgage means you’re paying off the house in half the time. However, a 15-year mortgage typically has higher monthly payments because you’re paying down the loan more quickly. Rates on a 15-year mortgage tend to be slightly less than a 30-year mortgage.

No comments:

Post a Comment